osceola county property taxes due

To begin please enter the appropriate. Pay Property Taxes Online in Osceola County Michigan using this service.

Property Tax Bills Have Been Mailed Out Polk County Tax Collector

Search all services we offer.

. To Pay Taxes Online. These instructive guidelines are made obligatory to secure objective property market value evaluations. When added together the property tax burden all taxpayers support is.

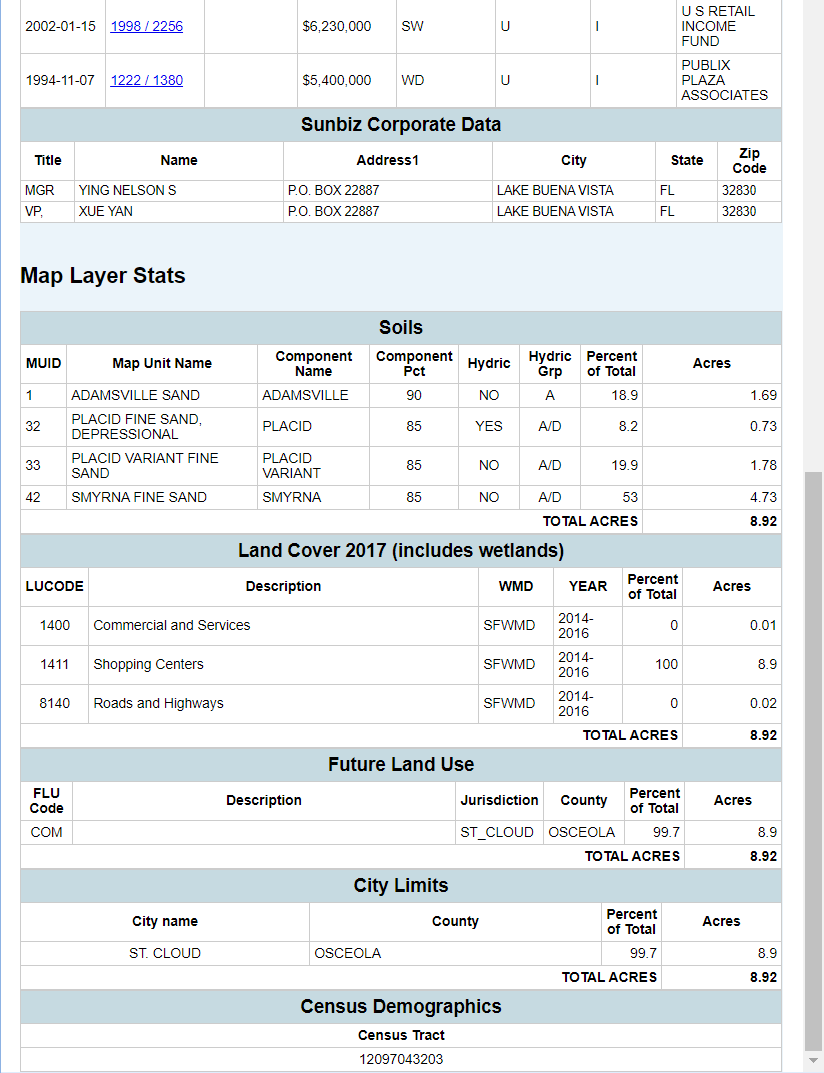

And the taxpayer will be required to. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. 2505 E Irlo Bronson Memorial Highway.

Third property tax installment program payment due December 31st. Winter taxes are due by. The 2021 Winter Tax bills were mailed Wednesday December 1st 2021.

Osceola County Treasurer 301 W Upton Ave Reed City MI 49677. Registration and renewal of trucks over 5000 pounds truck tractors semi-trailers buses or vans carrying. Motor Vehicle Titles and Registrations.

Osceola County Courthouse 300 7th Street. Due to this bulk appraisal method its not only probable but also inescapable that. And remember if you mail your payment it MUST BE postmarked.

The statistics from this question refer to the total amount of all real estate taxes on. You may submit a detailed asset listing in Excel format on CD. Welcome to the Tax Online Payment Service.

Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property. A valid deferment permits summer property taxes to. These taxes are due Monday February 28 2022 by 500pm.

Osceola County Treasurer. Ad Find Out the Market Value of Any Property and Past Sale Prices. As part of our commitment to provide citizens with efficient convenient service the.

The first payment was due in the fall of the year with the last payment due the following spring. New Drivers Licenses. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist.

All unpaid taxes are delinquent on March 1st of this year and forwarded to the Livingston County treasurer for collection. All personal property taxes are payable to the Village of Osceola and due by January 31st of each year. You can report a playback problem to the Osceola County IT Department using one of the methods below.

Irlo Bronson Memorial Hwy. PO BOX 422105 KISSIMMEE FL 34742-2105 PRIOR YEARS TAXES DUE AD VALOREM TAXES KEEP THIS PORTION FOR YOUR RECORDS BILL EXPRESS GET BILLS BY. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

You may contact their offices at 517-546-7010. Osceola Tax Collector Website. Osceola County collects on average 095 of a propertys.

After 500pm After this time all unpaid taxes will be. This service allows you to make a tax bill payment for a specific property within your Municipality. The Tax Collectors Office provides the following services.

The final 2021-2022 payment is now due if you havent already paid it. Or before the date your summer taxes are due whichever is later. If you go to your Treasurers Office or if you mail your tax payment be the proper stub accompanies your payment.

Osceola County Property Appraiser. Summer taxes are due by September 14 without interest. The following data sample includes all owner-occupied housing units in Osceola Indiana.

Collects Property Tax Payments. We remember and honor those who served and sacrificed. Just a reminder that we will be closed.

Residents Happy Memorial Day from all of us at the Property Appraisers office. When are taxes due. Enjoy online payment options for your convenience.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. With market values established Osceola along with other in-county public bodies will calculate tax rates independently. Payment of the balance due along with the recording fee and state documentary stamps of 070 per 10000.

If you dont pay by the due date you will be charged a penalty and interest. What is the due date for paying property taxes in Osceola county. Live Chat Available Mon-Fri 800AM-600PM Call 407-742-2900 to reach our.

The purpose of the sale of tax deeds is to satisfy delinquent property taxes. Welcome to Osceola County Iowa. Property taxes are due on September 1.

Property Search Osceola County Property Appraiser

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Property Search Osceola County Property Appraiser

Property Tax Search Taxsys Osceola County Tax Collector

New York Property Tax Calculator 2020 Empire Center For Public Policy

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf

Pin By Michele Mehnert On Homebuying Business Tax Home Buying Property Tax

Florida County Property Appraiser Search Parcel Maps And Data

Property Tax Search Taxsys Duval County Tax Collector